The steep uptick in 401k plan trades in reaction to the wild market swings over the last several weeks could be a precursor of a mass reallocation of participant portfolios to more conservative investments. We saw it during the 2008 crash and the summer slump of 2011 when investors fled the stock market en masse, with many remaining in cash or safer investments during the ensuing market recoveries. Even now, many 401k portfolios, especially those of investors closer to retirement, are heavily invested in bond and balanced funds. While that may lessen the sting of steep stock market decline, when applied through several market cycles of advances and declines, it is less likely to generate the long term returns necessary to build the amount of capital needed for lifetime income sufficiency.

As more plan sponsors take on the necessary responsibility of ensuring the retirement readiness of their plan participants by offering more financial education and advice, greater attention needs to be focused on the defects of behavioral investing which can lead to devastating mistakes by investors. When emotions drive investment decisions, it invariably leads to costly mistakes such as trying to time the market, chasing performance, or investing too conservatively. The retirement readiness of today’s employees hinges on their ability to avoid costly mistakes and apply the proven investment principles of discipline and patience in pursuing their long-term objectives.

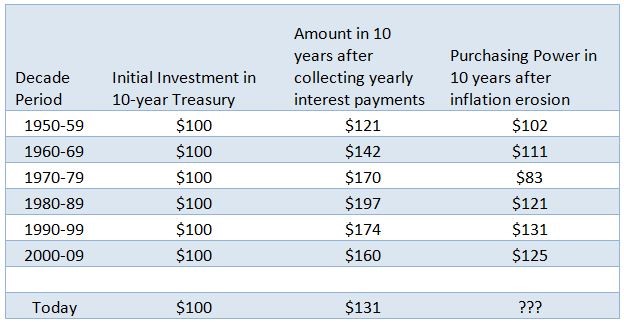

Why Conservative Investing can be a Costly Mistake

The chart below illustrates the erosion of purchasing power on earnings generated from an investment in 10-year Treasury Bonds. The decade of 2000 – 2009 had one of the lowest rates of inflation, as measured by the Consumer Price Index, in the last 30 years, yet purchasing power on the earned income was reduced by 25 percent. It is important to note that the CPI, which is the official government measure of inflation, doesn’t include food and gas prices which have increased at rate three times the CPI over the last couple of years. If food and gas prices were included in the CPI, the rate of inflation would be closer to 9 percent, and, at that rate, the net purchasing power of earnings in ten years would be less than the initial investment, meaning you would have lost money.

Source: National Association of Realtors, Economistsoutlookblog.realtor.org

Investing your money in safe or guaranteed instruments may provide peace-of-mind that you won’t lose any money due to market fluctuations; however, each day that your returns fail to exceed the rate of inflation, you are, in effect, losing money, and that loss becomes more pronounced over time.

There are ways to invest conservatively that will minimize market risk, reduce portfolio value volatility and overcome the risk of inflation. The key is in knowing what your financial objective is in real terms, factoring in the true cost-of-living and taxation, in order to know the minimum rate of return you need to generate, and, therefore, the level of risk you need to incur. With an investment strategy tailored to your specific needs, you need not take any more risk than is absolutely necessary to achieve your objective. And even with that, a well-conceived investment strategy will incorporate methods to mitigate most of the risk. The investors’ job is to stay focused on their objective.

Plan Sponsors Need to Help Participants Keep their Eye on their Objective, not the Market

During difficult markets, plan sponsors must provide a constant stream of education and advice to remind their participants of the long term effects of going too conservative. With a better understanding of how the markets work and the historical performance of the markets, investors will find it easier to allow their discipline win out over their emotions. Even a thousand point drop in the market will amount to nothing more than a small blip in terms of them achieving their long-term objectives.

Source by: http://www.lifeincrs.com/blog/are-your-employee-invested-retirement-or-playing-it-too-safe